The College Dream is Dead. Good. For decades, the script was simple: Hit th...

2025-11-04 14 gen z

So I’m reading two articles today, and I feel like I’m losing my mind.

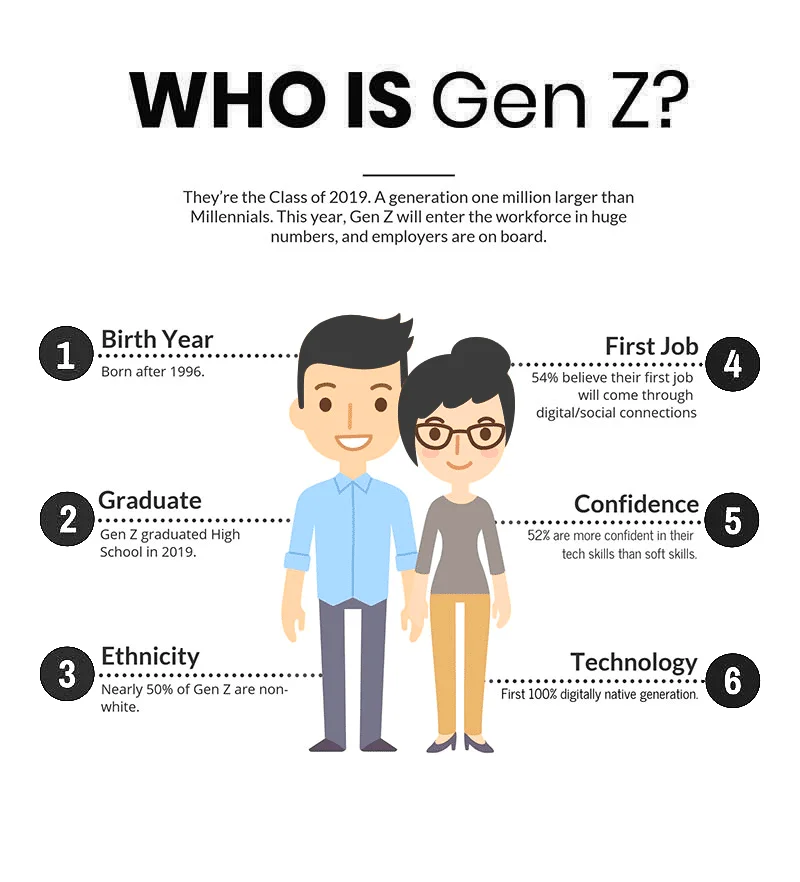

In one tab, I’ve got a report telling me that 84% of Gen Z—kids born after 1997—are literally putting their lives on hold to maybe, just maybe, afford a house someday. We’re talking no marriage, no kids, no career changes, not even a damn dog. The typical first-time homebuyer is now 40 years old. Forty.

In my other tab? A piece about how the mall brand PacSun is hosting a "Purpose Summit" and hiring a "youth advisory council" of TikTok influencers to figure out how to sell these same broke young people more distressed jeans.

Read those two paragraphs again. Let the sheer, weapons-grade absurdity of it all sink in. One system is demanding they sacrifice their entire youth for a sliver of stability, while another is trying to sell them a $60 hoodie as a form of self-expression. It’s a clown show, and we’re all sitting in the front row getting hit with seltzer water.

Let's get into the weeds of this housing nightmare, because the corporate-speak used to describe it is an insult to our intelligence. A real estate exec from Coldwell Banker, Jason Waugh, says there’s “no single fix” for the affordability crisis. You don’t say? That’s like a doctor telling a guy with a missing leg that there’s “no single fix” for his mobility issues. It’s a meaningless platitude designed to make inaction sound thoughtful.

He then praises Gen Z for being “resourceful and determined,” pointing to their side hustles, moving back in with their parents, and buying fixer-uppers, as detailed in A staggering 84% of Gen Z say they’re delaying milestones to buy a house. There’s ‘no single fix’ for the affordability crisis, real estate exec says. He even offers up an anecdote about a 20-year-old client who skipped college and worked for three years while living at home to buy a house. This is presented as a heartwarming tale of grit.

Am I the only one who reads that and feels sick? We're celebrating a kid forgoing an education—the very thing previous generations sold as the golden ticket—just to get on the first rung of a ladder whose other rungs have been sawed off. This isn't a story of success. It's a canary in a coal mine, and the canary is coughing up blood. Is this what winning looks like now? Trading a degree for a 30-year mortgage you can barely afford? Give me a break.

The numbers are just brutal. You need to make about $141,000 a year to afford a median-priced home, while the average salary is literally half that. It’s a mathematical impossibility for most people. This isn't a generation "redefining" the American Dream, as Waugh so cheerfully puts it. They're being foreclosed on before they even sign the papers. I remember my first apartment; the rent was a joke, and the idea of owning a home felt like an eventual, achievable step, not a mythical quest.

Now, let's pivot to the PacSun circus. While Gen Z is scraping together pennies from their DoorDash side-gigs, brands are desperately trying to "understand" them. PacSun’s CEO says getting inside their heads is "critical to a brand’s permanence and viability," according to the report PacSun taps Gen Z and Gen Alpha as advisors.

Let me translate that for you: "How can we continue to extract money from a generation that has none?"

They’ve assembled a council of influencers, some with millions of followers, to decode the youth. And what profound insights have they gleaned? Gen Z dresses how they want to feel, while the younger Gen Alpha dresses how they want to be seen. Groundbreaking stuff. Offcourse, it is. It's just repackaged marketing 101. They’re not listening to help; they’re listening for data points to feed into an algorithm that spits out the next viral pair of jeans.

One of the influencers, Anna Sitar, has a theory. She says that because Gen Z lacked control during the pandemic, they now cherish the "control" they have over "where we put our money and attention."

This is just marketing. No, "marketing" is too clean a word—it's a calculated psychological campaign to convince people that consumer choices are a substitute for real power. You can’t afford a house, you can’t afford to have kids, your student debt is crushing you, but hey, you have control over whether you buy the light-wash or the dark-wash denim. It’s an illusion of agency, a cheap consolation prize. They're selling them an identity because they can't afford a deed, and the worst part is... it seems to be working. Then again, maybe I'm the crazy one for thinking a stable future is more important than a trendy outfit.

Let’s be brutally honest here. We’re watching a generation get squeezed from both ends. The financial system has made the cornerstones of a stable adult life—a home, a family—into luxury goods. And while they’re fighting for scraps, the consumer culture machine is right there, whispering in their ear that their true value, their true power, lies in what they buy. It’s not a bug in the system; it’s the entire feature. We’re not watching Gen Z redefine the American Dream. We’re watching it being sold off for parts.

Tags: gen z

Related Articles

The College Dream is Dead. Good. For decades, the script was simple: Hit th...

2025-11-04 14 gen z