ALAB Stock's Wild Ride: What's Driving the Hype?

Alright, let's get one thing straight: I'm seeing Astera Labs (ALAB) plastered all over the finance blogs, and my BS meter is already pinging. Another freakin' chip stock promising the moon? Give me a break.

The Hype Train is Leaving the Station

So, ALAB is supposedly "outpacing" its Computer and Technology peers this year. Okay, fine. The Zacks report says it's up 44.6% year-to-date, while the sector average is a measly 29.5%. Big deal. Numbers can be twisted to say anything. My cat could probably outperform the market if you cherry-picked the right timeframe.

And get this: they're patting themselves on the back because the "Zacks Consensus Estimate" for ALAB's full-year earnings has "moved 70.9% higher" in three months. Translation: some analysts who probably couldn't tell a resistor from a capacitor decided to revise their estimates. Whoop-dee-doo. Does that actually mean the company is doing better? Or does it just mean the initial estimates were comically wrong? I'm betting on the latter.

Plus, they're comparing it to Allegro MicroSystems (ALGM), which is up 32.4% YTD. It's like they're desperately trying to find any other stock to make ALAB look even more amazing. It all feels a little too… orchestrated.

Oh, and speaking of orchestrated, let's talk about those analyst ratings. Nine firms issued "buy" ratings, and zero—ZERO—issued "sell" ratings. Seriously? Does anyone remember 2000? Or 2008? Or, hell, last Tuesday? The market is ALWAYS right...until it's catastrophically wrong. How are there no dissenting voices? Are they all drinking the same Kool-Aid? Makes you wonder who's paying for these "independent" analyses, ain't it?

Insider Trading: Red Flag City

Now, here's where things get interesting. Or, you know, suspicious. According to Quiver Quantitative, ALAB insiders have traded the stock 230 times in the last six months. And guess what? Every. Single. Trade. Was a sale. Not one freakin' purchase. $ALAB stock is up 14% today. Here's what we see in our data. Not one freakin' purchase.

The CEO, Jitendra Mohan, dumped over a million shares for a cool $114 million. The President and COO, Sanjay Gajendra, cashed out even more, selling 1,122,778 shares for $133 million. The CFO, the General Counsel... everyone's getting in on the sell-off.

What does that tell you? They're so confident in the long-term prospects of the company that they're, uh, divesting themselves of millions of dollars worth of stock? Yeah, right. It's like they know something we don't. Or maybe they just want to buy a few extra yachts before the music stops. Who knows? The point is, that level of uniform insider selling is never a good sign.

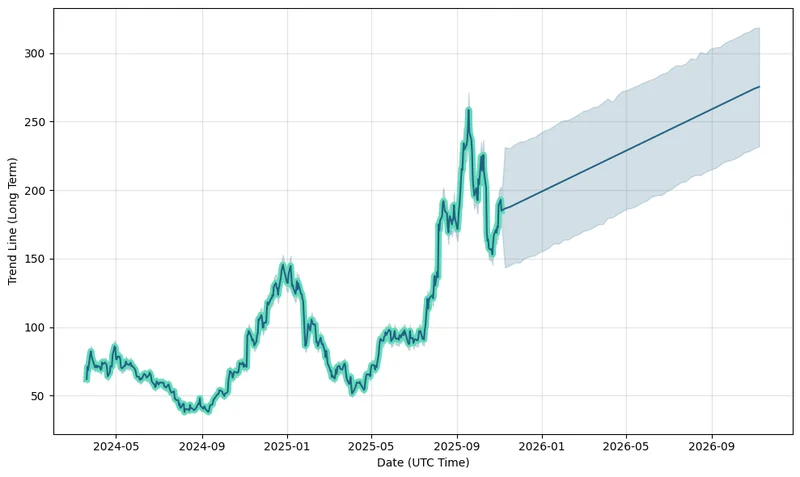

And while we're at it, what's with these price targets? Citigroup's analyst, Atif Malik, set a target of $275 back in September. Then Tom O'Malley from Barclays set a target price of $155.0 just a month later. That's a huge discrepancy. Are these people even talking to each other? Or are they just throwing darts at a board with dollar amounts on it?

I had a bad experience last week trying to get a refund on a faulty toaster. It was a whole thing.

The Verdict? Color Me Skeptical

Look, maybe Astera Labs is the real deal. Maybe they're revolutionizing the chip industry, and I'm just a grumpy old cynic who's missed the boat. But I've seen this movie before. The hype, the inflated valuations, the insider selling... it all adds up to a recipe for disaster.

Call me old fashioned, but I'll stick with companies that actually make something, not just promise to make something someday. And maybe, just maybe, I'll avoid any stock where the executives are running for the exits with wheelbarrows full of cash.

So, What's the Catch?

It smells like a pump-and-dump scheme to me. I'm staying far, far away.

Tags: alab stock

Solana: Upexi's holdings, founder's focus, and a price crash

Next PostSpotify's Stock Rebound: What's Driving the Bullish Growth?

Related Articles