So let me get this straight. Reddit reports a monster quarter. Revenue up 7...

2025-10-02 25 rddt stock

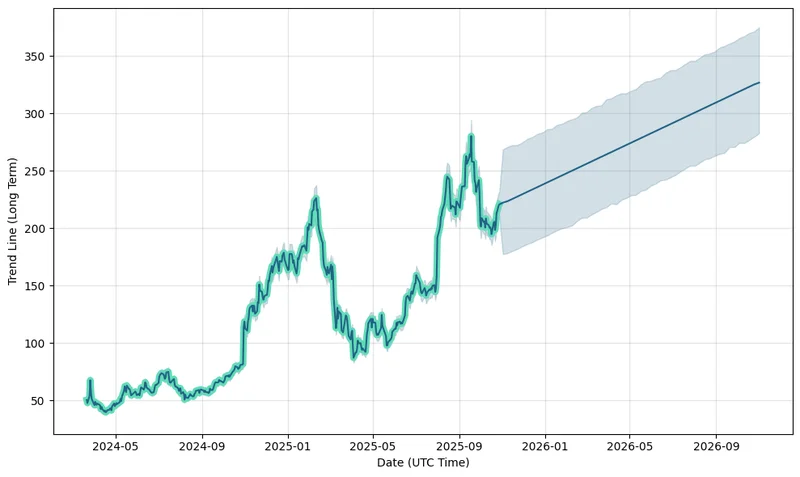

This Thursday, after the closing bell, Reddit will release its third-quarter earnings. On the surface, the consensus forecast is a picture of spectacular health. Wall Street expects earnings of $0.53 per share, a dramatic leap from the $0.16 reported in the same quarter last year. Revenue is projected to hit $549.12 million, a more than 57% year-over-year increase. Analysts, like Citi’s Ronald Josey, are raising price targets—his to $250—and adding the stock to a “90-day catalyst watch.” The consensus rating is a comfortable “Moderate Buy.”

This is the narrative: a high-growth social media platform successfully monetizing its vast user base, leveraging AI, and reaping the rewards of a platform redesign. It’s a clean, compelling story.

But data, real data, is rarely that clean. While the analyst reports paint a bullish picture, a different, more chaotic signal is emanating from the derivatives market. Options traders are pricing in a post-earnings swing of almost 14%—to be more exact, 13.95%—in either direction. This figure is not just a number; it’s a measurement of uncertainty. It’s the market’s quantitative assessment of how wrong the clean narrative could be, a sentiment captured in reports like Reddit’s (RDDT) Q3 Earnings Today: Options Traders Brace for a 13.95% Swing. This implied volatility is the financial market’s equivalent of a seismograph before a quake; it doesn’t tell you which way the ground will shift, only that a significant tremor is expected.

The core discrepancy is this: the analyst consensus suggests a stable, upward trajectory, while the options market is bracing for a violent move. Why the disconnect? If the path to $250 is so clear, why are traders paying a premium for protection against, or to speculate on, a double-digit percentage move? It suggests the headline numbers, as impressive as they are, might be masking a more complex and fragile reality.

The story investors will be watching extends far beyond simple ad revenue. The earnings call will be scrutinized for any commentary on the monetization of Reddit’s AI initiatives, from content moderation to personalization. These are no longer just features; they are expected to be profit centers. We have little concrete data on how, or if, these efforts are translating into scalable revenue streams. Is this the hidden engine that justifies the explosive growth expectations, or is it still a speculative, cash-burning project? Management's guidance for the fourth quarter and the upcoming fiscal year will be paramount, especially given the persistent macroeconomic questions.

And this is the part of the pre-earnings setup that I find genuinely puzzling. While Wall Street is focused on user engagement metrics and ad-spend momentum, a completely different market is treating Reddit not as a company, but as a pure trading instrument. The recent listing of RDDT perpetual futures on the crypto exchange Bitget is a significant development, an event announced in a Bitget Lists NFLX, FUTU, JD, RDDT, QQQ Stock Index Perpetual Futures press release. This allows traders globally to speculate on the stock’s price with leverage (up to 10x, a significant amplifier of risk), entirely outside the traditional stock market ecosystem.

This "financialization" of the stock adds a new layer of unpredictable volatility. It means the price action post-earnings won't just be driven by institutional investors digesting the 10-Q filing. It will also be influenced by a global network of crypto derivatives traders who may be operating on different information sets, time horizons, and risk tolerances. They aren't necessarily betting on the long-term health of Reddit's communities; they're betting on short-term price fluctuations. What happens when a stock with already high implied volatility becomes a 24/5 playground for leveraged speculation?

The question for investors isn't just whether Reddit can beat its earnings estimate. The question is whether the company can deliver a report so flawlessly perfect that it satisfies not only the growth-hungry analysts but also navigates the chaotic expectations priced into the global derivatives market. The company is no longer just managing a platform; it's managing a highly speculative financial asset.

Let's be clear. The market is not predicting a 14% drop. It is pricing in the possibility of a 14% move, up or down. But when expectations are this high—when a 231% jump in year-over-year EPS is the baseline—the risk becomes asymmetric. A solid report that merely meets expectations could be treated as a disappointment. A slight miss on revenue or a cautious word on guidance could easily trigger the downside of that volatility band. Reddit has to deliver a perfect print and a perfect forecast just to justify its current sentiment. Anything less, and the calm, bullish narrative will collide with the volatile, mathematical reality the options market has been signaling all along.

Tags: rddt stock

Related Articles

So let me get this straight. Reddit reports a monster quarter. Revenue up 7...

2025-10-02 25 rddt stock