The Gold Price Chart's Hidden Story: What Its All-Time Highs Reveal About Our Future

Gold Just Topped $4,000. It's Not About Greed—It's About Our Future.

I spend my days thinking about the future. I live and breathe the code, the algorithms, and the AI models that are rapidly reshaping our world. So, when I saw the news flash across my screen—gold cresting an astonishing $4,059 an ounce—I have to admit, I just sat back in my chair for a moment. Not as an investor, but as a technologist. In an age where we can create digital worlds, transact in cryptocurrencies born from pure math, and build intelligences that can write poetry, why are we collectively stampeding back to a shiny, heavy metal we’ve been digging out of the ground for 6,000 years?

The easy answer is inflation, market uncertainty, the usual economic headwinds. And sure, that’s part of it. Gold is up over 33% in the last year alone, a staggering climb. But I think something much deeper, much more fundamental is happening here. This isn’t just a financial data point; it’s a cultural one. We're not just hedging our portfolios; we're hedging our reality.

In a world that’s becoming increasingly abstract and dematerialized, gold has become our anchor. It’s the ultimate proof-of-work, not mined by servers in Iceland, but by geology and physics over eons. It’s a gravitational constant in an otherwise chaotic economic universe. And its soaring price is a powerful signal about the kind of foundation we feel we need to build the future we all dream of.

The Physicality of Trust

Let’s be clear: If you’re looking for explosive, short-term growth, gold probably isn’t your play. From 1971 to 2024, stocks delivered average annual returns of 10.7%, while gold clocked in at a more modest 7.9%. People who chase gold aren’t trying to build a rocket ship; they’re trying to build a launchpad. They see it as a store of value, a way to protect what they have against the turbulence of change.

Think about it. We talk about market indicators like the “spot price”—which, in simple terms, is just the price for a deal happening right now, a physical exchange, not a promise about the future. The very language of the market reveals our deep-seated need for tangible certainty. When the gap, or "spread," between the buying and selling price is small, it means the market is liquid and confident. It’s like a strong, steady heartbeat, a sign of a healthy, functioning system built on trust.

But what does it mean when trust in our complex financial systems drives us back to something so elementally simple? I see it as a profound and necessary counter-reaction to the digital revolution. The more our lives migrate into the cloud, into algorithms and virtual spaces, the more we crave something real, something we can hold. It’s the same instinct that makes us value a handcrafted wooden table in an age of mass-produced furniture, or a vinyl record in the era of streaming. Gold is the ultimate analog asset in a world going fully digital. It’s a touchstone to reality.

A Bridge Between Two Worlds

What I find truly fascinating is how we’re using our most advanced tools to interact with our most ancient asset. You don’t have to be a Bond villain with a private vault anymore. You can invest in gold through Exchange-Traded Funds (ETFs), which are essentially digital wrappers around physical gold, or futures contracts, which are bets on its future price without ever touching the metal.

This is the beautiful paradox of our moment—we’re using the very tools of abstraction and dematerialization to give ourselves easier access to the ultimate physical asset, and the speed at which this happens is just staggering, with algorithms executing trades in microseconds based on global sentiment that’s itself being analyzed by other AIs. It’s a dizzying dance between the primeval and the postmodern.

This isn’t a rejection of progress. It’s the integration of it. We are building a bridge. On one side, you have the immutable, physical reality of a gold bar—its atoms forged in a supernova billions of years ago. On the other, you have a global, instantaneous, digital financial system. Gold’s rising value is the market screaming that we need this bridge to be strong. We need to know that for all our digital castles in the sky, there is solid ground underneath. But with this immense concentration of value, what is our responsibility? Does hoarding an anchor asset in turbulent times help stabilize the ship for everyone, or does it just ensure the wealthiest have lifeboats?

Gold's Unspoken Promise

So, is now a good time to invest in gold? That’s a question for financial advisors. The more interesting question, for me, is why we’re even asking it with such urgency. The surge to over $4,000 isn’t a sign that we’re giving up on the future. It’s a sign that we’re getting serious about building it. Before we take our next great leap—into AI-driven economies, decentralized finance, and perhaps even worlds beyond our own—we are instinctively reaching for an anchor. We need to feel the reassuring weight of something real in our hands. Gold isn't a retreat into the past; it's the foundation from which we'll confidently launch ourselves into tomorrow.

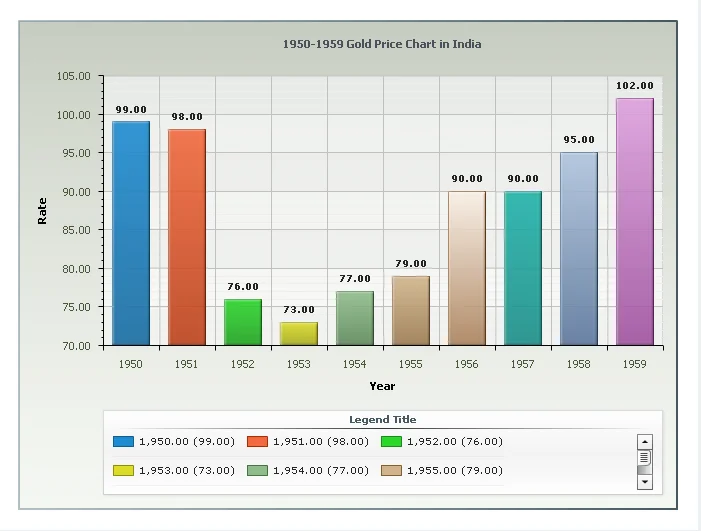

Tags: gold price chart

Bill Ackman's Trump Endorsement: The Hidden Tech Vision and What It Means for Innovation

Next PostThe Aster Breakthrough: What It Is and Why It Changes Everything

Related Articles