The Blockchain Revolution Isn't Over, It's Just Getting Started Okay, folks...

2025-11-09 9 blockchain

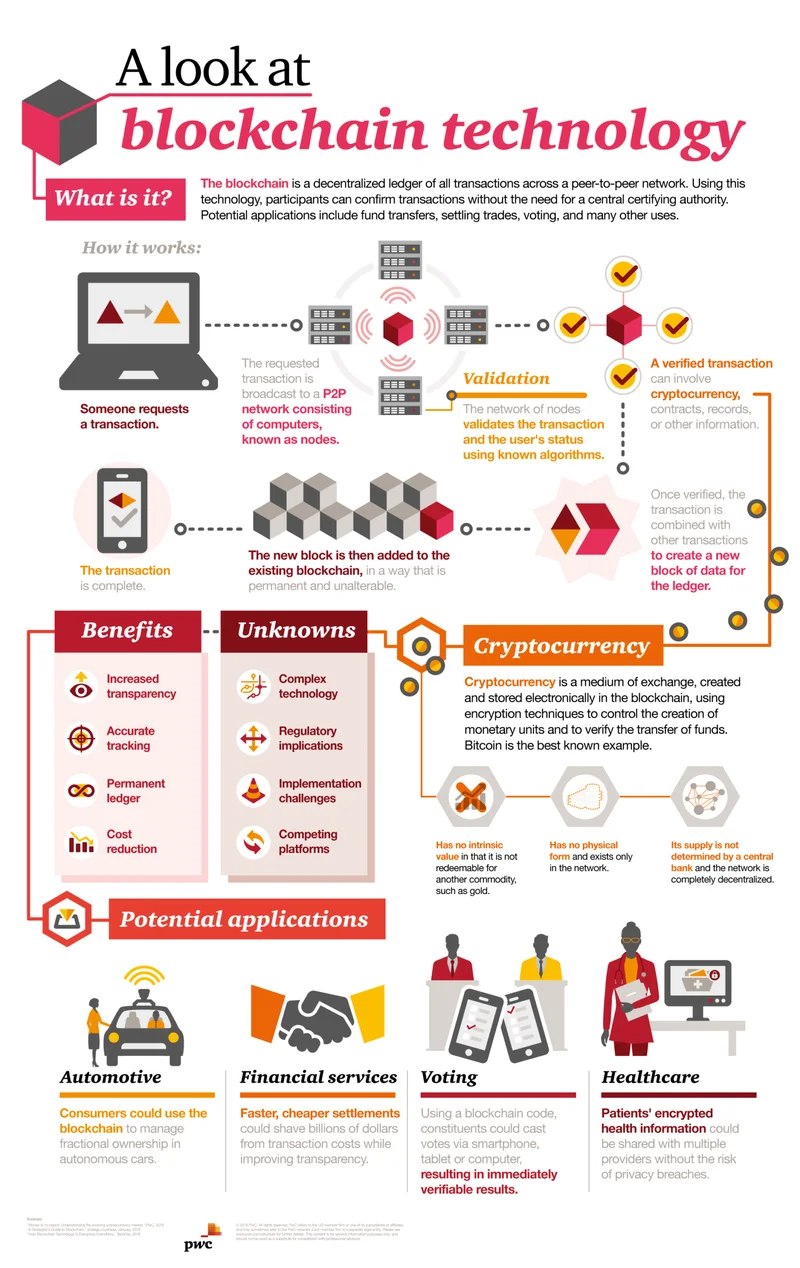

Dinari's collaboration with Chainlink to launch the S&P Digital Markets 50 Index is generating buzz. The index, a blend of 35 blockchain-related equities and 15 digital assets, aims to bridge traditional finance and the crypto world. Chainlink will provide real-time pricing data, ensuring transparency. But is this truly revolutionary, or just a fresh coat of paint on existing financial structures?

The promise of tokenized equities is enticing. Dinari plans to tokenize the index using its dShares platform, with a 1:1 asset-to-token ratio, shares held by a custodian. It’s a move toward greater accessibility and efficiency, echoing similar efforts by Backed and Robinhood. The question, though, is whether the market needs another tokenized index. We already have synthetic assets and tokenized stocks. What unique value does this bring?

One key challenge in the blockchain space is interoperability – how easily assets can move between different blockchains. Hyperbridge, a protocol built by two Nigerian founders, aims to solve this. They enable cross-chain transfers via cryptographic proofs and smart contracts, avoiding the vulnerabilities of multi-signature bridges (which rely on trusted individuals). The bridge market is projected to hit $2.55 billion by 2029, but is it truly decentralized? Hyperbridge argues that its solution is superior because it doesn't depend on human-controlled keys. How 2 Nigerians built $200m blockchain protocol: Hyperbridge

Hyperbridge has processed $92.4 million in transaction volume and verified 10.2 million finality proofs. But let's be clear: $92.4 million is a rounding error in the global financial system. The key is whether their technology can scale securely and efficiently to handle volumes comparable to traditional exchanges. The Polkadot DAO voting to make Hyperbridge the native bridge for the Polkadot network is a significant vote of confidence. But the real test lies in real-world adoption and resilience against potential attacks.

Chainlink is also tackling the privacy problem with its Confidential Compute service, slated for early access in 2026. This aims to enable private smart contracts, concealing transaction details and protecting sensitive data. This is critical for institutional adoption, where privacy is paramount. Chainlink's approach combines trusted execution environments (TEEs) with cryptographic techniques. But TEEs aren't foolproof; they have potential hardware vulnerabilities.

Chainlink Confidential Compute uses a decentralized system for secrets management via Chainlink DKG and the Vault DON. This distributes access to secrets among a quorum of independent node operators. It's a step in the right direction, but the devil is in the details. How robust is this system against sophisticated attacks? And what's the performance trade-off compared to non-private smart contracts? Chainlink Confidential Compute Unlocks Private Smart Contracts

I've looked at hundreds of these filings, and the reliance on "future technologies" is a common theme. Companies promise innovation, but the execution is often delayed or underwhelming. Chainlink Confidential Compute is promising, but it's years away from widespread adoption. And even then, it remains to be seen if it can truly deliver the level of privacy that institutions demand.

The S&P Digital Markets 50 Index is a step forward, but it's not a giant leap. Tokenization and interoperability are important, but privacy remains a critical hurdle. The success of these initiatives hinges on execution, security, and real-world adoption, not just marketing hype.

Tags: blockchain

Related Articles

The Blockchain Revolution Isn't Over, It's Just Getting Started Okay, folks...

2025-11-09 9 blockchain